2018中国市场报告:新消费革命已启幕(下)

文章来源: 撰写时间:2018-03-20作者:

下篇:消费升级趋势

Part II:Trend of Consumption Upgrading

一、消费升级的时代背景与主要特征

(I) Historical background and main features of the consumption upgrading

消费升级将成为主导今后较长时期经济增长的持续动力和强大引擎。而顺应和把握消费升级大势,以制度创新、技术创新、产品创新满足并创造消费需求,对于推动经济发展向中高端水平迈进,无疑具有十分重要的意义。

Consumption upgrading will be sustainable power and strong engine, which will be dominant in the future economic growth for a long time. Following and grasping the tendency of consumption upgrading, institutional innovation, technological innovation and production innovation are required to meet and create consumption demand, which is undoubtedly of great importance to enter into a middle and high level of the economic development.

在这股消费升级浪潮中,黄金珠宝首饰的消费升级备受瞩目。黄金珠宝首饰兼具商品属性和金融属性,集文化收藏、装饰佩戴、彰显个性、投资理财等多功能于一体,又与国民经济状况及消费者的收入和价值观的变化密切相关,已成为继房产、汽车之后,我国居民消费最具活力的新热点之一。

The consumption upgrading of gold and jewelry attract much attention in such tendency. Gold and jewelry possessing both commodity property and financial attribute, is an integration of cultural collection, decoration and adornment, displaying individuality as well as finance and investment. Gold and jewelry are also closely related with the national economy and the change of consumer's income and values, having become one of the most dynamic new hot spot following the real estate and cars in China's resident consumption.

对于黄金珠宝行业来说,这轮消费升级的意义还不尽如此。不仅珠宝市场正在和社会整体消费结构的变化同频共振,消费升级还被看作是带领珠宝行业“脱困”的契机所在。随着产业运行逻辑被颠覆和重新定义,通过终端消费升级反向牵引上游制造业,将成为行业转型升级、经济提质增效的先手棋和加速器。因此,应对消费升级的挑战,把握消费升级的机遇,不仅可以直接促进国内黄金珠宝市场蕴藏的巨大潜力和空间继续得到释放,还能充分发挥消费引领作用,带动整个黄金珠宝产业转型升级,不断推动黄金珠宝产业持续、健康、稳定发展。

Gold and jewelry industry must achieve more in this round of consumption upgrading. The transformation of the social overall consumption structure brings a synchronous change to the jewelry market, as well, the consumption upgrading also has been regarded as the opportunity to get the jewelry industry out of the current dilemma. As the industry operation logic is reversed and redefined, reversely pulling upstream manufacturing industry through the terminal consumption upgrading will become an offensive move and accelerator to transform and upgrade industry and improve the quality and efficiency of the economy. Therefore, to challenge the consumption upgrading and grasp this opportunity, not only can directly promote the continuous release of enormous potential and space of domestic gold and jewelry market, also can give full play to the consumption leading role, so as to drive the transformation and upgrading of the gold and jewelry industry, and promote the sustainable, healthy and stable development of the gold and jewelry industry.

80后、90后成为黄金珠宝消费新动力

The post-80s and post-90s become the new consumption power of gold and jewelry

根据数据显示,18-39岁的消费者计划未来一年在珠宝首饰上消费2001-8000元的占比近50%。该年龄段消费者对各种首饰材质的购买意愿也最为强烈。

The data show that nearly 50% of the consumers at the age of 18-39 plan to spend RMB2001-8000 on jewelries in the coming year. These consumers also own the strongest wish to buy various jewelry materials.

目前,“80后”、“90后”已经逐渐成长为中国消费升级的中坚力量。曾经的抢金大妈们,俨然已退居二线,有钱任性的“小仙女们”开始扛起黄金珠宝消费的大旗。随着根据调查结果统计,“18-29岁消费者中,月收入在3001-5000元的比重最高。而30-39岁消费者中,月收入在5001-8000元的比重最高,可以看出,在进入工作的5-10年内收入增长迅速。可见,未来“90后”的收入水平上升潜力巨大,加之其较高的边际消费倾向,对消费市场的提振作用将会很大。这一年龄层中的中产消费者越来越注重品质,而不是性价比,他们正逐渐取代“小康之家”,成为品牌最渴望覆盖的群体,对市场影响巨大。

At present, the "post-80s" and "post-90s" have gradually grown into the backbone force in Chinese consumption upgrade. The grandmas who ever rushed to buy gold have retreated to the back and the rich and willful "fairies" pick up the banner of gold and jewelry consumption. According to the statistics in survey result, "the highest percentage of consumers at the age of 18-29 have a monthly income of RMB3001-5000. However, among the consumers at the age of 30-39, those who have a monthly income of RMB5001-8000 account for the highest percentage. It can be seen that their income increases rapidly after working for 5-10 years. Apparently, the income of "post-90s" has a great potential of rising in the future, which, together with the relatively high marginal consumption trend, will produce a significant impact on boosting the consumption market. The middle class consumers in this age group increasingly focus on quality instead of cost performance. They are gradually replacing the "well-off families" and becoming the primary group that brands wish to cover, having a tremendous impact on the market.

“二孩”“限购”国家政策释放珠宝消费潜力

National "second child" and "purchase limitation" policies release the jewelry consumption potential

据统计数据显示,中国目前有 4.3 亿个家庭,“全面二孩”政策正式落地是我国人口政策的重大调整,直接影响到我国的家庭结构,消费产业也在“二孩政策”新机遇下出现新变革,除了母婴用品市场,珠宝消费也将带来勃勃生机。

The statistical data shows that China has 430 million families currently. The formal implementation of "universal two-child policy" is a major adjustment of China's population policies and directly affects China's family structure. Facing the new opportunity of "second child policy", the consumption industry also undergoes a new change. Apart from the baby product market, the jewelry consumption will also bring vitality.

可以预见到,在未来的几年中,二孩政策对于黄金珠宝产业的影响,特别是婴儿饰品的款式与设计带来的新发展。如何获取每年极速递增的婴儿首饰的消费就成为珠宝生产加工企业的侧重点之一。

Predictably, the second child polity will affect the gold and jewelry industry in the coming years, especially bring new development of the style and design of babies' jewelry. How to gain the rapidly increasing consumption market of babies' jewelry will become one of the priorities of jewelry production and processing enterprises.

除了全面开放二孩政策外,房屋限购等政策对刺激消费也有积极作用,特别是对居民消费潜力的释放。近7成被访者没有房贷,而这部分消费者对黄金珠宝首饰的购买力非常可观,超过五成消费者愿意消费高于 5000元的珠宝首饰。

In addition to the universal two-child policy, the purchase limitation of houses and other policies also have a positive effect on stimulating the consumption, especially releasing the consumption potential of residents. Almost 70% respondents have no house loan and have a very considerable purchasing power for gold and jewelry. Over 50% consumers are willing to buy the jewelry at a price of higher than RMB 5,000.

可见,不论是全面二孩还是限购,国家政策带来的消费利好将刺激黄金珠宝消费市场的增长。

Therefore, the consumption increase brought by national policies such as universal two-child and purchase limitation will stimulate the growth of gold and jewelry consumption market.

家庭观念正在回归——珠宝要有更多情感文化内涵

The sense of family is returning - jewelries should contain more emotional and cultural connotation

在调查中,57.9%的受访者愿意花更多业余时间陪家人,超过60%的受访对象选择珠宝作为礼物,送给爱人、父母,有30%以上选择给子女,还有13.94%选择馈赠亲朋好友……从把追求事业成功当做人生奋斗目标,到把陪伴家人作为业余时间最重要的生活选择时,这是家庭观念回归的重要体现。

During the investigation, 57.9% respondents are willing to spend more time with their families, over 60% respondents give jewelries to their lovers and parents as gifts, over 30% respondents give to their children and another 13.94% respondents give to their friends...they treat the pursuit of a successful career as the lifelong objective of struggle and treat accompanying family members as their most important activity during the leisure time, which obviously reflects the returning of the sense of family.

家庭是社会的细胞。家庭的文明进步关系到整个社会文明程度的提高。对于珠宝行业来说,首先应注重设计和宣传打造具有传承概念的珠宝。因为越来越多的消费者对中国传统文化的理解在不断加深,并把目光投向具有文化概念和独一性的具有传承概念的传世珠宝。一些品牌企业、知名设计师们已经在有意识地设计和制作有别于量产的珠宝,由于其款式设计、原料选购、人文标识都是独一无二的,带有消费者本人的个人烙印、品位特征,相对于大众款式珠宝而言,更有文化底蕴和个人特色,也更适合家族收藏传承。

A family is a cell of the society. The civilization and progress of families relate to the improvement of civilization degree of the whole society. For the jewelry industry, the first priority lies in designing, advertising and building up jewelries presenting the concept of inheritance. This is because more consumers are constantly deepening their understanding of Chinese traditional culture and throwing their sight on the jewelry handed down from ancient times featured by cultural concept, uniqueness and concept of inheritance. Some brand enterprises and well-known designers have been consciously designing and making jewelries different from those in mass production. Due to the unique style design, material selection and cultural logo, these jewelries have more cultural deposits and personal characteristics compared with the jewelries of popular styles and are suitable for collection and inheritance of families.

“花今天的钱办明天的事”信用消费取代储蓄消费

"Spend today's money to enjoy tomorrow's life" - credit consumption replaces the deposit consumption

数据显示,中国近 1.7 亿“90 后”中,超过 4500 万开通了花呗,平均每 4 个“90 后”就有 1 个人在用花呗进行信用消费。这种消费习惯的变化,在越年轻的人群中越明显。近 40% 的“90 后”把花呗设为支付宝首选的支付方式,比“85 前”高出 11.9 个百分比。同时,“90后”们的信用消费非常理性,爱花钱却并不任性。近七成的花呗年轻用户都能做到“月月有余”,每月花销控制在授信额度的 2/3 以内。

The data shows that among the nearly 170 million "post-90s", over 45 million have opened up the Ant Credit Pay and one in every 4 "post-90s" is using the Ant Credit Pay for credit consumption. The change of consumption habit is more obvious in younger people. Nearly 40% "post-90s" set Ant Credit Pay as the preferred payment mode, which is 11.9% higher than the "pre-85s". In addition, the "post-90s" use the credit consumption in a very reasonable manner. They spend much, but not willfully. Nearly 70% young Ant Credit Pay users keep "a certain balance every month" and control the monthly expenses within 2/3 of the credit limit.

成长在信用理念、信用应用不断普及下的“90 后”,对信用的认知和珍视程度也比“老一代”更强。从“90后”对珠宝首饰消费选择来看,这一群体的消费习惯呈现出明显的消费数量多、金额少,也就是“求潮不求贵”的特点。除了这一群体经济实力尚处于“蓄力阶段”,更与他们的消费习惯息息相关——讲求个性, 自己喜欢和能体现风格才是关键,懂得为品质买单。

The "post-90s" growing in the era that the credit concept and credit application are constantly popularized perceive and treasure the credit more than the "older generation". As the selection of "post-90s" in jewelry consumption shows, they present a consumption habit featured by the large number

and less amount, i.e., "seeking for fashion instead of luxury". Apart from staying at the "charging stage" in the economic strength, they have their own consumption habit that determining the above feature - pay attention to personality, treat their own flavor and style as the key and pay for high quality.

珠宝私人定制进入“平民”时代

Private customization of jewelry enters the "civilian" era

当下,“80”后、“90”后已逐渐成为消费主力军,他们更加关注珠宝首饰的个性化,崇尚原创、注重设计,希望珠宝首饰的设计能够更好地体现自己的情感寄托。在个性化消费浪潮的推动下,私人定制珠宝首饰成为行走时尚尖端的潮人的不二选择。

At present, "post-80s" and "post-90s" have gradually become the main consumption force. They pay more attention to the personalization of jewelries, advocate the original and lay emphasis on design and wish the design of jewelries can reflect their own emotional sustenance better. Promoted by the wave of personalized consumption, private customization of jewelries has become the primary option of the trendsetters walking at the tip of fashion.

私人定制珠宝有别于量产的珠宝,因其稀缺性及文化和审美的渗透力,成为新的热门。“珠宝私人定制”就像是为珠宝赋予生命的过程,工匠与设计师赋予的珠宝不仅是稀有价值和精湛技艺,更像是在表达一个人的生活态度和价值观。从稀有宝石的甄选,到金属材料的选择;从款式线条的设计,到融入个性化元素的工艺,真正的定制珠宝由内到外都有着自己的印记,彰显不一样的生活态度。同时,消费者可以随时控制其中的花费,让消费者能购买到更具性价比的珠宝首饰。

The customized jewelry is different from the jewelry in mass production due to its rareness and cultural and aesthetic penetration and has become the new hotspot. "Private customization of jewelry" is like the process of vitalizing the jewelry. The craftsman and designer not only endow the jewelry with rare value and exquisite skill, but also express the life attitude and value of a person. From selection of rare gemstone to selection of metal material; From design of style and line to technology integrated with personalized element, the real customized jewelry has its own imprint from the inside to outside and demonstrates a distinctive life attitude. In the meanwhile, the consumers can control the costs at any time, which help them obtain the jewelries with a better cost performance.

珠宝品类多元化趋势明显

Categories of jewelries present a diversified trend

时代在变化,消费者的口味也在变化。对于珠宝行业来说,伴随消费群体的年轻化而来消费升级需求,乃是重中之重。

The flavor of consumer changes with the era. Upgrading the consumption demand against the younger consumption group is the top priority for the jewelry industry.

目前来看,黄金、钻石和铂金仍是消费者购买珠宝时首先考虑的品类。这主要是因为消费者对于珠宝首饰的品类选择仍然比较传统,倾向于有较高认知度和保值度的品类。但近年来受消费者心理和金价下跌的驱动,个性化珠宝首饰越来越受大众欢迎,对传统品类珠宝构成了潜在威胁,珠宝品类多元化的趋势日益明显。

At present, gold, diamond and platinum remain the firstly considered categories of the jewelry consumers. This is mainly because the consumers are still relatively conventional in selecting the category of jewelry and prefer the categories with higher recognition and hedging feature. However, driven by the consumers' psychology and fall of golden price in recent years, the personalized jewelries are increasingly welcomed by the masses, which poses a potential threat to the traditional categories. The diversity trend of jewelries is gradually obvious.

2017 年,黄金珠宝首饰中开始融入浓重的时尚色彩,旨在迎合年轻一代的审美习惯。混搭风、民族风、简约风等等都开始出现在黄金首饰的设计中,随着金饰的设计感和潮流感的增强,越来越多的年轻人选择为自己购置黄金饰品,既美观又保值。

Since 2017, the thick fashion color has been added to the gold and jewelry to meet the aesthetic habit of the younger generation. Mix-and-match style, ethnic style, simple style, etc. appeared in the design of gold jewelries. With the enhancement of design and fashion sense of the gold jewelry, more young people select to buy gold jewelries for themselves, both aesthetic and value-saving.

曾经一度被视为“老奶奶”的配饰的珍珠成为近两年大热的珠宝品类,在设计师天马行空的设计中大肆回潮,呈现出或个性或可爱或优雅的风格。同时,珍珠的形态在也不再拘泥于珠圆玉润,异形珠配饰格外抢镜;同时, K 金饰品就势崛起,不同于黄金的保值属性,K 金的核心在于设计,多变的颜色和个性化的设计使其正逐渐成为年轻人的新宠,18~30 岁年龄段的消费者占整个 K 金市场的39%。

The pearls which were deemed as the accessories of "old grandma" has become a hot jewelry category in recent two years, return to fashion rapidly with the unfettered design of the designer and presented personalized, lovely or elegant style. In the meanwhile, the form of pearl is not limited to round and smooth and pearl accessories of special shapes steal the scene; In addition, K gold jewelries suddenly rise. Different from the gold with value-saving attribute, K gold has its core in the design. Diverse colors and personalized design gradually make it the new favorite of young people and consumers at the age of 18-30 occupy 39% of the whole K gold market.

营销仍是内容为王

Content is still the key of marketing

从调查问卷中,我们看到消费者获取产品信息的渠道更为明确直接,最主要的方式就是在购物类APP和品牌网站上查看,而通过其他间接媒介平台获取产品信息的方式正在被摒弃,因此,传统广告分发渠道正在逐步萎缩。在经历过直播、VR等技术风口的渐次爆发,目前主流的内容载体包括资讯、视频、短视频及直播等。多元内容载体的蓬勃发展,使消费者的消费习惯和偏好都在不断升级。

The questionnaire shows that consumers obtain the product information through clearer and more direct channels. The primary manner is browsing in the shopping APP and brand website, but the manner to obtain product information through other indirect media platform is abandoned. Therefore, the traditional advertisement distribution channels are gradually shrinking. After undergoing the outbreak of broadcasting, VR technology, etc. one after another, the current mainstream content carriers include information, video, short video and broadcasting. The booming of diversified content carriers enables the constant upgrade of the consumers' consumption habit and preference.

在消费升级和内容升级的大环境下,一方面,受到信息传播媒介影响,人们的消费观念和消费习惯逐渐改变,内容导购成为除了传统硬广展示外另一种广受关注的营销方式。消费者更愿意为情怀、内容买单,产品故事销售模式兴起,区别于广告模式的内容型产品,能获得更多的忠实用户。另一方面,在需求和市场的引导下,用户为优质内容付费的习惯逐步形成。内容付费形式能够聚集大批具有付费意愿的高净值人群,伴随着内容生态的崛起,为内容变现带来更大想象空间。

Under the great environment of consumption and content upgrade and affected by the information transmission media, people's consumption concept and habit gradually change and the content-based shopping guide becomes another widely recognized marketing mode apart from the traditional hard sell and display. The consumers are more willing to pay for feelings and contents. The product story marketing mode is rising. The content-type product different from the advertisement mode can obtain more faithful users. On the other hand, users form the habit of paying for the high-quality contents under the guidance of demand and market. The form of content payment can gather many high net-worth groups. With the development of content ecology, a larger imaginary space will be created for realization on content.

线上内容输出 线下场景体验

Online content output and offline scenario experience

在新零售时代,更多的人开始思考实体店的价值。业内专家认为,实体门店在体验方面具有天然优势,而互联网技术可以为消费者提供更多便捷服务,两者互为补充。越来越多的零售商们开始陆续对线下门店进行新场景改造。通过对商品体验价值的挖掘,重新定义渠道价值。

In the era of new retail, more people begin to think about the value of physical stores. The industrial experts consider that: physical stores have inherent advantages in experience, while the Internet technology can provide more convenient services for the consumers, so they complement each other. An increasing number of retailers begin to modify the offline stores following new scenarios constantly. Redefine the channel value through discovering the experience value of commodities.

特别是一些小众、圈子类的消费场景,如个性设计工坊、买手集合店、主题会所等消费渠道,在增加年轻消费群体黏性的同时,也可以培育新的消费需求。

In particular, some minority or circle-type consumption scenarios, such as personalized design workshop, buyer multi-brand store, theme club, etc. increase the viscosity of young consumer groups while cultivating new consumption demands.

在当前体验至上的消费环境下,重新定义零售,全渠道任意穿行的购物体验,带领消费者玩转新零售,搭建的 24 小时购物场景才能深受消费者喜爱。

Under the current consumption environment of "experience first", redefine the retail, create the shopping experience of randomly travelling through all channels and building up the 24-hour shopping scenarios, which will be loved by the consumers.

品牌时代——找到“特别”的定位

Brand era - find the position of "special"

在消费升级的背景下,“小众”成为了主流,这个“小众”不是小众珠宝品牌,而是一种“独特”的需求。在问卷调查中,我们发现,无论是千禧一代,还是“80后”,他们不同于长辈,特别强调“独特”和自我的体验感。因此,一个珠宝品牌,无论是国内品牌还是国际品牌,抑或独立设计师品牌,或者轻奢品牌,不需要让所有人群都喜欢,而是认真地选择一个用户群,将一个区间做到极致。用自己的“独特”来获取这个用户群高度的认可度、黏性和复购率。

Under the background of consumption upgrade, "minority" becomes the mainstream. The "minority" means a "unique" demand, not a minority jewelry brand. During the questionnaire survey, we found the millennial generation and "post-80s" are different from their elders and specially emphasize the "unique" and their own experience. Therefore, a jewelry brand, regardless of domestic or international brand and independent designer or affordable luxury, need not meet the flavor of all people, but should meet the demand of a certain user group and do the best. It must take advantage of its "uniqueness" to obtain the high recognition degree, viscosity and re-purchase rate of such user group.

对于“特别”的“80后”、“90后”来说,希望用消费品来彰显自己的个性,那些触动内心深处,打动心灵的品牌以及体验,更能令之获得幸福感并为之买单。

The "special" "post-80s" and "post-90s" wish to use the consumer goods to demonstrate their own personality. The brand and experience touching the cockles of the heart and the spirit can give them more happiness and gain their payment.

参与、交互、智能——未来珠宝产品新方向

Participation, interaction, intelligence - new direction of jewelry products in the future

调研显示,在珠宝首饰生产销售过程中,消费者与品牌互动的意愿较为强烈。用珠宝首饰彰显个性的需求在增强,对珠宝感知力、功能性、智能化、互联方面的追求在提升。对于未来的珠宝首饰,除了简单的装饰品属性,功能性、实用性、智能化等新需求也开始被提及。未来,能够具有“参与”“交互”“智能”特点的珠宝产品将迎来消费者的购买兴趣。

The investigation shows that the consumers have a strong willingness to interact with the brand during the production and sales process of the jewelries. The demand for demonstrating the personality by the jewelry is being enhanced and the pursuit of the perceptivity, functionality, intelligence and interconnection of the jewelry is increasing. For the future jewelries, apart from the simple decoration attributes, the new demand such as functionality, practicability and intelligence have also been mentioned. In the future, the jewelry products with the characteristics of "participation", "interaction" and "intelligence" will cause the consumers' interest of purchase.

参与感要做的,是让顾客做一件自己过去本身想做,但可能做不了的事情,增加他的控制感。通过提供独特性的体验,提供参与感。消费者过去买到的是固定的、标准化的珠宝首饰,而购买有参与感的首饰,相当于是自己在创造一件首饰,生产出一份属于你自己的东西,获得一种独特性的体验。

The sense of participation means allowing the customer to do something that he wants to do, but may not be able to do in the past and thereby increasing his sense of control. Provide the customers with the sense of participation by enabling the unique experience. In the past, the consumers bought fixed-style and standard jewelries. However, buying the jewelries with a sense of participation means creating a jewelry on your own and producing a thing belonging to yourself, Enjoy the unique experience.

二、消费升级下的消费行为表现

(II) Performance of consuming behaviors under the consumption upgrading

(一)黄金是主流产品

(I) Gold serves as the mainstream product.

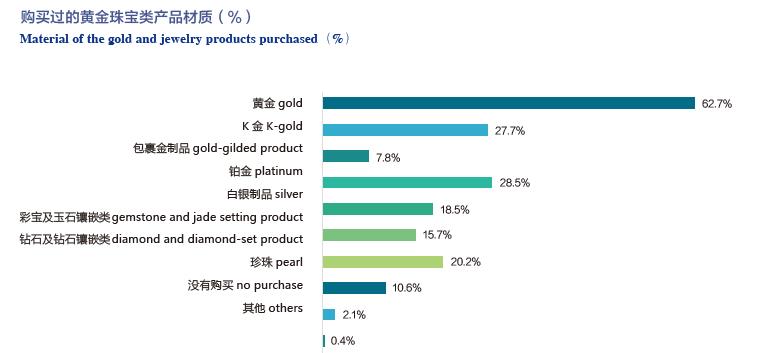

2015 年以来,在消费者已经购买过的首饰产品中,购买最多的是黄金材质的产品,占比达到62.7%;其次为铂金,占比28.5%;再次为K 金,占比27.7%;钻石及钻石镶嵌类的消费占比为20.2%;白银制品、彩宝及玉石镶嵌类和珍珠的消费占比相对较低,占比分别为18.6%、15.7% 和10.6%;消费占比最少的是包裹金制品,占比仅为7.8%。这组数据说明,在已经发生的消费中,黄金是绝对主流的产品。值得注意的是,K 金首饰也占到了一定的比例。市场中,K 金首饰已经占到了相当的份额。

Since 2015, among jewelries consumers have already purchased, the gold-related products rank at the top (standing at 62.7% of the total), followed by platinum (accounting for 28.5%), K-gold jewelries (accounting for 27.7%), as well as diamond and the related mosaic (accounting for 20.2%). Besides, silver products, colored gems and jade mosaic, as well as pearl, with a relatively-low proportion, account for 18.6%, 15.7% and 10.6%, respectively. The proportion of gold-gilded products, which is the least, is only 7.8%. This group of data indicates that gold, within the scope of consumers spending, is the absolutely mainstream product. It is noteworthy that, K-gold jewelries also account for a certain percentage. They have seized a considerable proportion of market share.

(二)50 岁以上消费者爱买手镯

(II) Consumers over the age of 50 prefer bracelets.

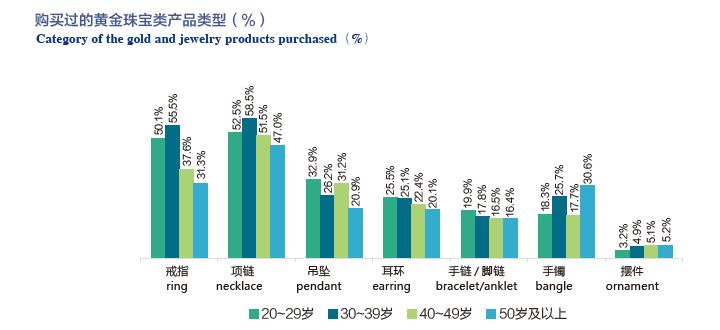

数据显示,项链、戒指是消费者最喜爱购买的产品。同时30~39 岁的消费者购买项链和戒指的比例明显高于其他年龄层;50 岁以上的消费者购买手镯的比例相对较高。

The statistics have indicated that necklaces and rings are the favorite products for consumers. The proportion of 30 to 39-year-old lovers of necklaces and rings is significantly higher than that of other age groups; Bracelets enjoy a large following in the age group of 50 plus.

从不同性别来看,女性人群在购买项链、吊坠、耳环和手镯等类型的产品的比例,明显高于男性;而男性人群购买戒指和摆件的比例相对较高。因为“购买婚戒”已经成为结婚刚需之一,所以相对而言,男士购买戒指的比例偏高。

From a perspective of gender, in comparison with men, women are lovers of necklaces, pendants, earrings, bracelets, and such. By contrast, men prefer to channel their capitals into rings and ornaments. Since “a wedding ring” has become a precondition for a marriage, the proportion of men buying rings is relatively high.

(三)内地品牌是主流

(III) The brands originated from the mainland serve as mainstream.

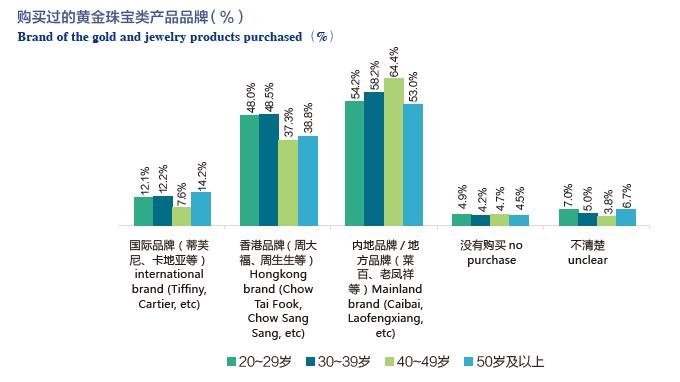

在已经发生的消费行为中,内地品牌/ 地方品牌是消费者购买黄金珠宝时的主要选择,占比达到57.7%;其次为香港品牌,占比44.7%;购买过国际品牌产品的消费者仅占11.5%。

Among the consumers behaviors which have been recorded, the brands originated from the mainland or some characteristic localities are the main choices of purchasers of gold and jewelries, accounting for 57.7% of the total products, with their counterparts from Hong Kong followed (of 44.7%). The proportion of consumers who have purchased international-branded products stands at only 11.5%.

在市场中,内地品牌是绝对主流的产品。但我们也应该看到香港品牌在市场中的影响力(占比44.7%)。一些香港品牌进入内地市场较早,在消费者心目中有较广泛的认知,也曾经是很多内地连锁品牌学习的模板。直到今日,他们在培训和管理中的一些经验,仍然值得内地品牌借鉴。

Therefore, we can draw a conclusion that the mainland-oriented brands come out first in the market. However, we should also see the influence of the Hong Kong-based brands with a market share of 44.7%. It has been a long time since some Hong Kong-based brands gained a foothold in the mainland market; they have gained a widespread recognition among consumers, and served as an example for many mainland-oriented chain brands. To date, some of their experience in terms of training and management still merits reference from mainland-oriented brands.

(四)年轻人更喜欢国际和香港品牌

(IV) Youngsters prefer international- and Hong Kong-based brands.

从不同年龄层来看,40~49 岁的消费者选择内地品牌/ 地方品牌的比例较高,选择国际品牌的比例相对较低。年轻消费者(20~39 岁)选择国际品牌和香港品牌的比例,明显高于其他年龄层。在国内市场,一些消费者已有国际品牌代表高端、香港品牌代表中高端、内地品牌代表性价比的思维定式。从数据中看出,如果想赢得年轻消费者者的心(他们也代表着市场的未来),珠宝零售企业们需要对品牌持续升级。

Seen from different age groups, consumers aged 40-49 prefer mainland/local-based brands, rather than international-oriented brands. Obviously, international- and Hong Kong-based brands enjoy a large following in younger consumers of 20-39 years old. In the domestic market, some consumers have a thinking pattern that these three kinds of brands have different characteristics: international brands - high-end; Hong Kong brands - mid- and high-end; mainland brands: better-value-for-money. The statistics have shown that jewelry retailers should renew their efforts in upgrading their brands before winning the hearts of young consumers (who represent an upward future of the market).

不同性别的消费者购买过的品牌的分布比例与整体消费者相似。其中,女性人群选择内地品牌/ 地方品牌的比例,高于男性4 个百分点;而男性人群选择香港品牌的比例,高于女性3 个百分点。

The distribution of brands purchased by consumers of different genders is similar to that of overall consumers. The proportion of female population who choose mainland/local brands is 4% higher than that of male, whereas the proportion of men choosing Hong Kong brands is 3% higher than that of women.

(五)网购珠宝成交价低

(V) The on-line jewelry transaction suffers from a low price.

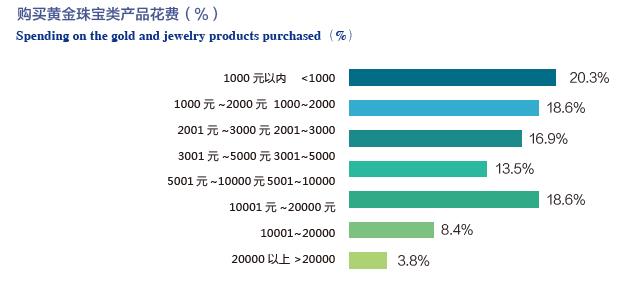

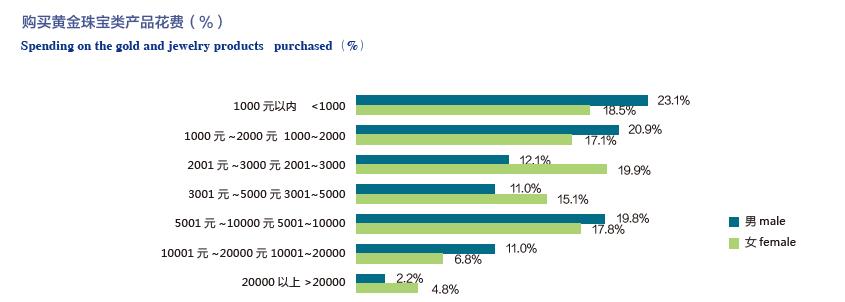

目前,可供选择的在网络上购买珠宝的渠道很多。除几个大型电子商务平台中的旗舰店外,官网、微信公众号都是可购买珠宝首饰类产品的渠道。在有过珠宝首饰网购经历的人群中购买黄金珠宝类产品的花费主要集中在1000 元以内,占比20.3%。;其次为1000 元~2000 元和5001 元~10000 元,占比18.6%;再次为2001 元~3000 元,占比16.9%;花费在20000 元以上的消费者仅占3.8%。与实体平台相比,网络购买珠宝呈现成交价低的特点。在购买贵重的黄金珠宝类产品时,消费者对网络平台的信任度仍处于较低水平。

At present, there are many channels for on-line jewelry shopping. In addition to the flagship stores affiliated to several e-commerce platforms, the official website, and WeChat public number are available for the purchase of jewelry-related products. More often, the consumers, with the experience of on-line jewelry shopping, have their spending less than RMB 1,000, which accounts for 20.3% of the total. The next is RMB 1,000 to 2,000, along with RMB 5001 to 10,000, accounting for 18.6%. The third is RMB 2001 to 3,000, standing at 16.9%. The proportion of consumers who spend more than RMB 20,000 is merely 3.8%. Compared with physical platforms, on-line jewelry shopping shows its characteristic of low price. The consumers who purchase precious gold-related products and jewelries don’t have much confidence in on-line platforms.

(六) 男性网购珠宝比例更高

(VI) Men enjoy a higher proportion of on-line jewelry shopping.

从不同性别来看,男性人群在网络上购买过黄金珠宝类产品的比例更高,高于女性5 个百分点。其中,女性人群在网络上购买黄金珠宝类产品的消费在2001 元~5000 元和20000 元以上的区间里占比高于男性;其他消费区间里,男性人群的占比高于女性。从不同年龄层来看,20~39 岁的消费者在网络上购买过黄金珠宝类产品的比例远高于40 岁以上的消费者。

Seen from the gender, the proportion of male population doing the on-line purchase of gold-related products and jewelries is even higher, 5 percentage higher than that of female. In comparison with men, there are more women who do the on-line shopping of gold-related products and jewelries, with their spending ranging from RMB 2001 ~ 5000 and of RMB 20,000 plus. As for other consumption ranges, men enjoy a higher proportion than women. Seen from different age groups, on-line purchase of gold-related products and jewelries enjoy a larger following in consumers over the age of 40, compared with 20- to 39-year-old consumers.

(七)看不到实物是网购最大风险

(VII) The fact that objects are not tangible poses great risk to on-line shopping.

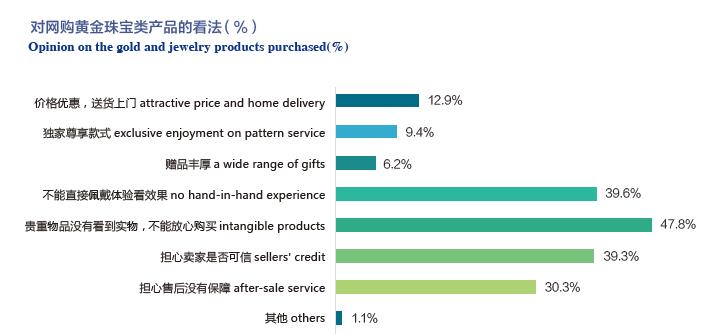

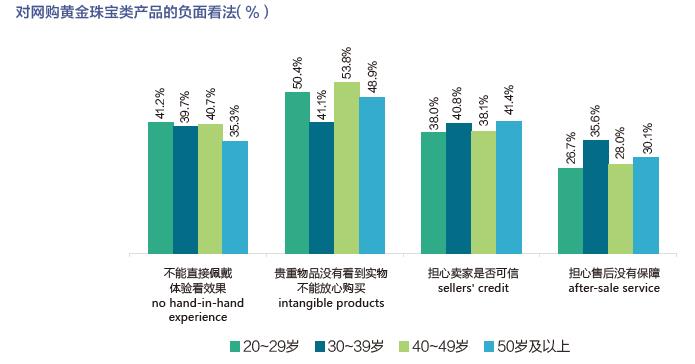

消费者对于从网络上购买黄金珠宝类产品的主要看法是贵重物品但没有看到实物,不能放心购买,占比47.8%;其次为不能直接佩戴体验看效果,占比39.6%;再次为担心卖家是否可信,占比39.3%;担心售后没有保障的比例也较高,占比30.3%。商家在发展线上渠道时,需要将诚信问题放在第一位,打消消费者的顾虑,建立信任感。

A proportion of 47.8%: consumers are deeply concerned about the fact that such expensive gold-related products and jewelries, not tangible as they are, are brought on the Internet. A proportion of 39.6%: consumers maintain that on-line shopping cannot afford the hand-in-hand experience of wearing these jewelries, which is a pity. A proportion of 39.3%: consumers doubt whether the sellers are trustworthy. A proportion of 30.3%: consumers don’t have much confidence in after-sales service. As for on-line retailing channels, trustworthiness should be prioritized, in order to dispel consumers’ concerns and build up a sense of trust between sellers and consumers.

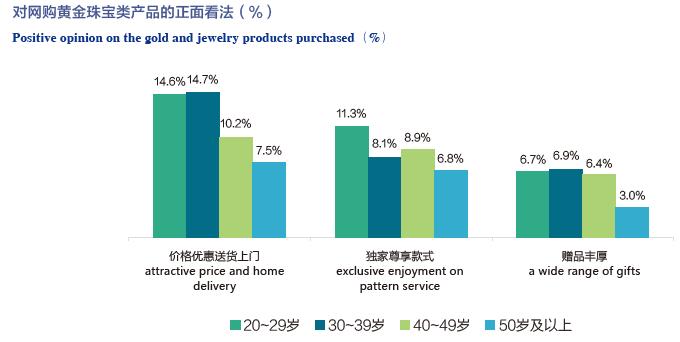

消费者对于网购黄金珠宝类产品的正面看法占比最高的是价格优惠,送货上门,比例为12.9%;其次为独家尊享款式,占比9.4%;再次为赠品丰厚,占比6.2%。

Benefitting from attractive price and home delivery, on-line shopping of gold-related products and jewelries enjoys much popularity among consumers who account for 12.9%. The next is 9.4%, as for the service pattern of exclusive enjoyment. The third is 6.2%, as for a wide range of gifts.

(八)年轻人在意个性款式

(VIII) Youngsters care more about personality and style.

不同年龄层的消费者对于网购黄金珠宝类产品的正面看法差异较为明显,30 岁~39 岁的消费者比较注重价格优惠,送货上门;其中20 岁~29 岁的消费者对独家尊享款式更为看重。从负面看法来看,20 岁~29 岁消费者最关心不能直接佩戴体验看效果。

People of different age groups hold a different positive view about on-line shopping of gold-related products and jewelries. 30 to 39-year-old consumers are more particular about affordable price and home delivery. In particular, consumers of 20 to 29-years-old prefer the service pattern of exclusive enjoyment. As for the negative point, consumers aged 20 to 29 are most concerned about the fact that on-line shopping cannot afford any hand-in-hand experience.

从不同性别的角度来看,男性人群更注重价格优惠,送货上门,同时也对贵重物品没看到实物,不能放心购买和售后保障问题担心较多;女性人群则更注重独家尊享款式与丰厚的赠品。

Seen from the gender, men attach more importance to attractive price and home delivery; on the other hand, a majority of them also worry about the intangible products and the poor after-sales service in the future. The female population pays more attention to exclusive enjoyment and generous gifts.

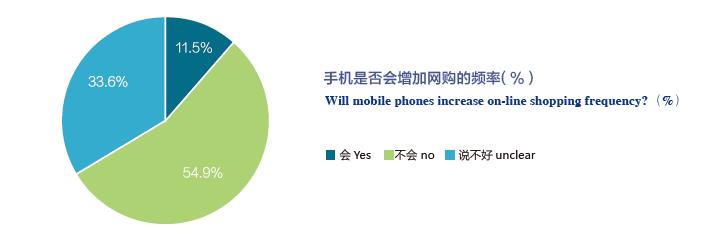

(九)手机对网购产生了一定影响

(IX) Mobile phones have exerted a certain impact on on-line shopping.

54.9% 的消费者表示,手机上网的便利性并不能增加其网上购买黄金珠宝类产品的频率;其次有33.6% 的消费者表示说不好;而11.5% 的消费者则表示会增加网上购买黄金珠宝类产品的频率。数据显示,手机上网的便利对网购产生了一定影响。但消费者在网上购买黄金珠宝类产品时,对实物、佩戴效果、商家诚信和售后服务等问题均有较大顾虑。

54.9% of consumers comment that notwithstanding the convenience of mobile phone’s access to the Internet, they are still loath to engage in the on-line shopping of gold-related products and jewelries. This is followed by 33.6% of consumers who torn between physical platforms and on-line outlets. While 11.5% of consumers comment that mobile phone’s access to the Internet will increase the frequency of their on-line purchase of gold-related products and jewelries. The statistics have shown that the convenient phone’s access to the Internet has brought some benefits to on-line shopping. However, the consumers who engage in the on-line shopping of gold-related products and jewelries are deeply concerned about such affairs as tangible objects, wearing effects, sellers’ trustworthiness, after-sales service, and such.

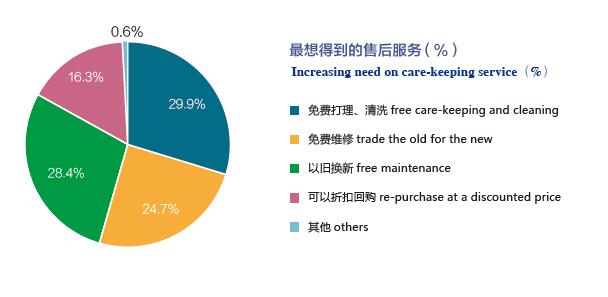

(十)免费打理清洗需求大

(X) The business of free care-keeping is more and more popular.

调查结果显示,消费者最想得到的售后服务为免费打理、清洗,占29.9%;其次以旧换新,占28.4%,再次是免费维修,占24.7%;可以折价回购的比例为16.3%。在日常经营中,好的售后服务可以有效提升顾客的黏性。

The people surveyed comment that there is an increasing need, which accounts for 29.9%, of care-keeping and cleaning, which is free of charge, among consumers. The second is trading in the old for the new, accounting for 28.4%; the third if free maintenance, accounting for 24.7%. The last is the re-purchase at a discounted price, accounting for 16.3%. In daily business, thanks to considerate after-sales service, there will be more and more frequent visitors.

三、消费升级下的区域市场特点

(III) Features of regional markets under the consumption upgrading

2017年历时4个月, 、北京黄金经济发展研究中心工作人员调研了东北、华北、华东、中南、西南等多各区域的200多个全国重点金店,通过数据抓取的方式,对于当地市场的消费特点梳理和归纳出具有切实依据的区域消费特点。

In 2017, the staff members of China Gold Newspaper and Beijing Gold Economic Development Research Center coordinated a four-month survey in more than 200 key gold stores across Northeast China, North China, East China, Central China, Southwest China, and so on. By means of random data acquisition, they have got a detailed picture of the consumption pattern of local market, and, based on the practical reality, summed up the characteristics of regional consumption.

(一)华北消费者更看重知名度和口碑,且品牌忠诚度较高。

(I) The consumers in North China pay more attention to reputation and fame, and at the same time, they tend to frequent those brand-stores which they are familiar with.

北方金店的店面面积普遍比南方大,消费者的消费心理也存在较大差异。被问及首选进入一家黄金珠宝店购物的原因时,从不同区域的调查结果看,华南地区由于服务业普遍发达,消费者对于活动和服务的考虑明显要少,相对更看重质量保障、款式新颖、档次齐全;东北地区消费者则对于服务和活动考虑较多;华北区域消费者相对看重的是门店的知名度、口碑;其他方面则大体一致。

In the northern part of China, the stores engaging in the sales of gold-related products have a larger area than their counterparts in the south; on the other hand, as for the mentality of consumers, there is also an obvious difference. When asked about the reasons why they choose to do shopping in a store engaging in the sales of gold-related products and jewelries, because of the developed service industries, the consumers in Southern China, different from other regions, are more particular about quality assurance, novel styles , and a broad range of selection, instead of activities and services. By contrast, the northeast consumers attach more importance to services and activities. The consumers in North China frequent those well-reputed stores. As for other aspects, rare difference can be found.

不同区域的消费者对首选的黄金珠宝卖场体现出较高的忠诚度,特别是华北区域选择非常可能继续去该店购买的比例最高;忠诚度相对低一点的是华东和西南区域。

Consumers in different regions show their higher loyalty to those preferred stores engaging in the sales of gold-related products and jewelries; especially in North China, the consumers are more than likely to frequent those stores which they are familiar with. By contrast, the consumers in East China and Southeast China prefer a fairly broad range of selection.

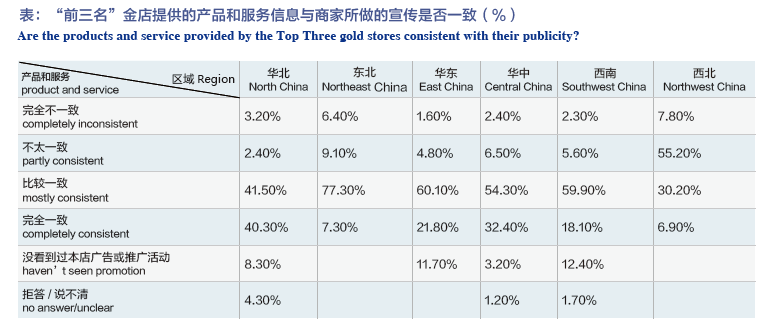

(二)东北消费者最信任商家,也最爱去商场

(II) The Northeast consumers, who, in comparison with their counterparts in other regions, have much confidence in sellers, usually do shopping at various malls.

总体而言,消费者对首选黄金珠宝销售店面介绍的产品和服务信息表现出了信任感,消费者认为商家介绍的产品和服务信息与自身感知情况较为一致。

Generally speaking, consumers show their confidence in products introduction and service information provided by their preferred stores engaging in the sales of gold-related products and jewelries, and in their opinion, the information on products and service is consistent with their perceptions.

从不同区域来看,华东和西南区域没有看到过本店广告或推广活动的比例较高。东北区域对介绍的产品和服务信息和感知情况一致评价较高。

Seen from different regions, it’s often the case that the consumers in East China and Southwest China are not familiar with products advertisement, and also, they don’t participate in such promotions. The consumers in Northeast China comment that the products and service are entitled to high praise for the perfect integration of theoretical introduction and practical use feelings.

在调查各地区消费者购买黄金珠宝的渠道时,可以看到传统的黄金珠宝品牌的独立店面,以及大型商场的黄金珠宝专区是七大区域消费者购物最主要的渠道。

As for the channels through which consumers in various regions do the purchase of gold-related products and jewelries, we can see that traditional independent stores and dedicated sections for jewelry-related sales in large-scale malls are the most frequented destinations for consumers in the seven regions.

此外,从不同区域的差异来看,华北、华东、西南区域的消费者更倾向于在黄金珠宝品牌的独立店面购买,东北区域的消费者在商场珠宝专区的购买的比例明显高于其他区域。

In addition, seen from the regional differences, the consumers in North China, East China and Southwest China are more likely to do the purchase in independent brand-stores, while their counterparts in Northeast China prefer dedicated sections for jewelry-related sales in large-scale malls.

各地区消费者喜欢的首饰风格普遍以简约和时尚为主。东北消费者对于卡通风接受度相对要高一些;华南消费者相对最喜欢华丽风;西南、西北对于复古风格受众更多。

Jewelries characterized with simplicity and fashionable styles enjoy high popularity among consumers across different regions. The Northeast consumers prefer jewelries characterized with cartoon patterns Jewelries with gorgeous styles are most pursued among the consumers in South China. In Southwest China and Northwest China, the retro style finds its audience.

(三)华东消费者对价格敏感

(III) The consumers in East China are price-sensitive.

从不同区域来看,消费者对首选店面诚信评价选择较多的都是商品明码标价、价签标示规范,商品定价合理方面;选择少、认可度低的都集中在商品售出前请消费者验货和承诺售后服务、保障项目及期限方面。

In different regions, the consumers are sensitive to the trustworthiness-related remarks of their preferred stores, such as price tag which is clear-cut, specifications on price labels, and reasonable price. Those stores suffering from a lack of visitors and a poor reputation are more than likely to do a bad job of consumers’ acceptance prior to sales, promise of after-sales service, as well as warranty items and period.

对自己的首选金店,华东区域的消费者对商品定价合理性相对其他区域评价较低,对价格相对敏感。华南区域对承诺售后服务、保障项目及期限指标评价突出的低,说明在该区域,店家应该更加的注重售后服务。西南区域消费者对于商品售出前请消费者验货评价相对较低,该区域的卖家应该注重流程规范的改进。

As for their preferred stores engaging in the sales of gold-related products and jewelries, the consumers in East China, price-sensitive as they are, are more particular about reasonable price. The consumers in South China are choosy about such affairs as promise of after-sales service, as well as warranty items and period. Thus, the sellers in this region should put more stress on after-sales service. The consumers in the Southwest are dissatisfied with consumers’ acceptance prior to sales. Thus, the sellers in this region should renew their efforts in the process improvement.

(四)华南消费者最追求创意,喜爱港资品牌。

(IV) The consumers in South China, attaching more importance to innovation, are fond of Hong Kong-oriented brands.

对于首选店面,各区域消费者认知评价客观反映了优秀金店的特点。分析各区域消费者主观重视的门店特征可以发现,品牌、口碑、质量遥遥领先。横向比较来看,华北消费者重视卖场产品的做工精良;东北消费者重视卖场环境和服务态度;华东、西南消费者相对看重卖场诚信和价格(明码标价,价格合理);华南区域消费者更追求设计、创意;华中区域消费者重视卖场的产品品类齐全和服务态度;西北地区消费者更希望产品做工精良、档次齐全。

Consumers give objective remarks on their preferred stores, which reflect the characteristics of excellent stores engaging in the sales of gold-related products and jewelries. An analysis of the characteristics of those stores wining the hearts of consumers across different regions reveals that brand, reputation and quality head the list. Seen from different regions, the consumers in North China focus on the workmanship of products sold in the malls. The Northeast consumers attach importance to favorable environment and considerate service of the malls. The consumers in East China and Southwest China relatively value trustworthiness and price (clear-cut price tag, and reasonable price). The consumers in South China are particular about novel designs and creativities. The consumers in Central China levy more emphasis on a broad range of products categories and considerate service. The Northwest consumers prefer products characterized with good workmanship and a broad range of selection.

此外,全国六大区域(华南例外)消费黄金珠宝产品品牌均以内地品牌比例最高,其次以香港品牌为主,国际品牌差距较大。2015 年以来,购买过的首饰产品中,华南区域消费情况特殊,80% 消费者购买的香港品牌,远大于50% 购买内地品牌的占比。

In addition, among all the brands of gold-related products and jewelries sold in the six regions (except for South China), the mainland-based brands come out first, followed by their counterparts headquartered in Hong Kong brands. There is a big difference between international-oriented brands. Since 2015, among various jewelries which have been sold, the consumption pattern in South China is exceptional. 80% of consumers prefer Hong Kong-based brands, where the number for mainland-based brands is merely 50%.

(五)华中消费者重视首饰个性

(V) The Consumers in Central China attach importance to distinct personalities of jewelries.

各地区消费者对于首饰功能定位以装饰和时尚为主。华中消费者更多重视其展现个性的功能;东北消费者尤其不认同其代表品味、身份的象征意义。

Consumers in all regions maintain that jewelries should have the functions of decoration and fashion. The consumers in Central China pay more attention to show their distinct personalities. The Northeast consumers, in particular, do not agree with the fact that jewelries serves as the epitome of taste and identity.

(六)西南市场要加强黄金珠宝专业知识讲解服务,更愿意通过电视渠道了解信息。

(VI) The sellers in Southwest China should coordinate some seminars to popularize the professional knowledge of gold-related products and jewelries, and consumers are more willing to acquire the related information on TV.

在消费者了解的首选金店拥有的服务中,不同区域的店面,能够提供清洗、维修等售后服务及提供商品包装服务以及提供回收、以旧换新服务都比较多。在消费者的心目中,华东、华南区域提供特殊安保服务的比例相对较少,都达不到10%。而西南和西北的消费者则认为,当地商家提供黄金珠宝专业知识讲解服务的比例相对较少,需要商家举办一些活动,来增加消费者对黄金珠宝的认和。

The consumers’ preferred stores, across different regions, engaging in the sales of gold-related products and jewelries, are more than likely to offer various service, such as after-sales service of cleaning and maintenance, goods packaging and recycling, trade-in, and so on. In the minds of consumers, the proportion of stores in East China and South China which offer such service as special security guard is relatively low, namely, less than 10%. However, the consumers in southwest and northwest believe that the proportion of local stores which coordinate some seminars to popularize the professional knowledge of gold-related products and jewelries is relatively small. Thus, the sellers should organize some activities, in order to increase consumers’ recognition of gold-related products and jewelries.

此外,由于各地区人们生活、交往习惯差异较大,在了解信息的渠道方面,大家都会选择相对信任的媒介,因此各地消费者了解黄金珠宝的主要渠道有较大不同。

In addition, because consumers across different regions have great differences in living environment and communication habits, they tend to choose a relatively trustworthy medium for information acquisition. Therefore, the main channels for consumers to get a picture of gold-related products and jewelries are quite different.

电视/ 广播、微信公众号以及报刊杂志都是各大区域消费者品牌信息获取的重要渠道,其中西南、华北区域以电视/ 广播渠道了解较多,电视渠道具有动态效果,具有更大的影响力,适合塑造品牌形象;华北、东北、华东、华中区域通过微信公众号了解珠宝首饰的信息较多。

TV/radio, WeChat public number and newspapers and magazines are important channels for consumers across different regions to get a picture of gold-related products and jewelries. Among them, the consumers in Southwest China and North China prefer TV/radio channels, which are characterized with more dynamic influence, and are also suitable for shaping the brand image. In North China, Northeast China, East China, Central China, WeChat public number enjoys high popularity.

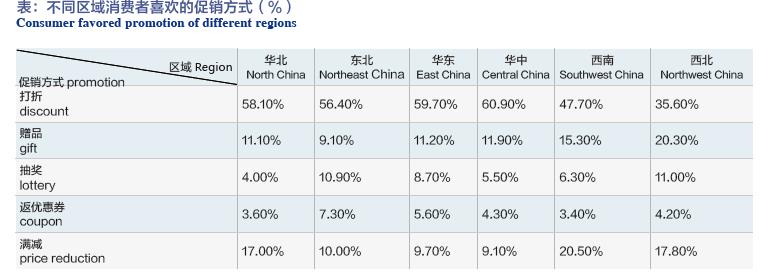

(七)西北消费者最喜欢买赠的促销方式

(VII) Promotion activities are most pursued by the Northwest consumers.

不同区域消费者喜欢的促销方式较为集中,均以打折为第一选择,且占比都很高。其次,以满减和赠品为主。西北地区消费者相对最喜欢赠品,知名金店可以根据不同区域消费者对促销活动的喜爱程度针对性的策划特色活动。

In different regions, consumers prefer similar Promotion activities - products, sold at a discounted price, are their first choice, with products characterized with a lower price and gifts followed. Relatively speaking, the Northwest consumers like gifts most; the well-known stores, according to the preference of consumers across different regions, coordinate various promotion activities.

此外,西北和东北消费者较少购买K金首饰。2015 年以来各大区域的各种材质首饰的购买情况和总体状况都保持一致,排名第一的是纯金,因其保值效果好,是大家最传统购买的首饰品类,各区域购买比例均过半。其次是铂金。在排名第三的K 金上,西北和东北区域的拥有率相对较低(分别是14.9%和15.4% )

In addition, the proportion of the consumers in the Northwest and Northeast who do the purchase of K-gold jewelries is relatively low. Since 2015, the purchase of various kinds of jewelries sold in different regions has been consistent with the overall situation. Pure gold, benefitting from its high potential of appreciation, takes the lead. It, as the most commonly purchased kind of jewelry, accounts for more than 50% of the total sales across different regions. The next is platinum. K-gold jewelries, ranking the third place, have a relatively low ownership in the Northwest and Northeast regions, 14.9% and 15.4% respectively.

特别说明

为满足国际业者的需求, 、北京黄金经济发展研究中心出版的《2017中国黄金珠宝消费升级研究报告》、《2017中国黄金珠宝消费调查白皮书》等系列研究报告,将推出英文版定制服务,并提供有关中国市场的顾问咨询、专题调研报告委托研究等第三方服务。

To satisfy the needs of international participants, custom service to provide English versions of Research Report on China's Gold and Jewelry Consumption Upgrading 2017, White Papers of China's Gold and Jewelry Consumption Survey 2017 and other research reports in this series published by the China Gold Press and Beijing Gold Economic Research Center will be launched; and third-party services like consultation on relevant Chinese market conditions and commissioned research in special field will also be offered.

详情请联系:

刘瑞梅 liuruimei1969@163.com 13811396281

Name: Liuruimei email: liuruimei1969@163.com Phone No. 0086 -13811396281。

首页

首页